Table of Contents

ToggleRecovering Funds from Old Bitcoin Wallet Sites

Recovering Funds from Old Bitcoin Wallet Sites with Crypto Recovery Solution

Recovering Funds from Old Bitcoin Wallet Sites: In the ever-evolving world of cryptocurrency, the landscape of digital wallets has seen numerous transformations. Many early adopters of Bitcoin might find themselves in possession of old Bitcoin wallets, some of which have become inaccessible due to forgotten passwords, lost private keys, or obsolete platforms. Fortunately, Crypto Recovery Solution is here to help you reclaim your digital assets from these old Bitcoin wallet sites.

The Challenge of Old Bitcoin Wallets

Old Bitcoin wallets, especially those created in the early days of Bitcoin, present unique challenges. These wallets were often hosted on now-defunct platforms or utilized security protocols that have since evolved. As a result, users might find it difficult to access their funds due to:

Lost Private Keys: Private keys are crucial for accessing and managing Bitcoin wallets. Losing these keys can make it impossible to access the funds.

Obsolete Wallet Platforms: Some wallet providers from the early days of Bitcoin are no longer operational, making it challenging to retrieve funds stored on their platforms.

Forgotten Passwords: Over time, it’s easy to forget passwords, especially for wallets that haven’t been accessed in years.

How Crypto Recovery Solution Can Help

Crypto Recovery Solution specializes in recovering lost or inaccessible cryptocurrency funds. Leveraging advanced technology and extensive expertise in blockchain forensics, our team is equipped to tackle the complexities associated with old Bitcoin wallets.

Advanced Tools and Techniques: We utilize sophisticated tools like the Ethan Hack private key recovery tool, which employs advanced algorithms to crack lost private keys. This state-of-the-art technology allows us to retrieve funds from wallets that might otherwise be deemed inaccessible.

Expertise in Blockchain Forensics: Our team consists of experts with a deep understanding of blockchain technology. We can trace and recover funds from wallets on obsolete platforms, ensuring that no stone is left unturned in the recovery process.

Secure and Confidential Process: At Crypto Recovery Solution, we prioritize the security and confidentiality of our clients. Our recovery process is designed to protect your privacy and ensure that your funds are returned safely.

Case Study: Successful Recovery from an Old Bitcoin Wallet

One of our clients had an old Bitcoin wallet from 2011. The wallet was hosted on a platform that had long since shut down, and the client had lost the private key. Using the Ethan Hack tool and our blockchain forensics expertise, we successfully retrieved the funds, amounting to over 50 BTC, and returned them to the client.

Why Choose Crypto Recovery Solution?

Proven Track Record: Our success stories speak volumes about our ability to recover lost cryptocurrency funds.

Cutting-Edge Technology: We leverage the latest technology to tackle even the most challenging recovery cases.

Client-Centric Approach: We work closely with our clients, providing regular updates and ensuring a smooth recovery process.

Conclusion

If you have funds locked away in old Bitcoin wallets, don’t despair. Crypto Recovery Solution is here to help you navigate the complexities of retrieving your digital assets. Our expertise, advanced tools, and commitment to client satisfaction make us the go-to service for recovering cryptocurrency from old wallet sites.

For more information, visit Crypto Recovery Solution and let us help you reclaim what’s rightfully yours.

Recovering Funds from Old Bitcoin Wallet Sites for Free

Recovering Funds from Old Bitcoin Wallet Sites for Free

Recovering Funds from Old Bitcoin Wallet Sites: The discovery of a forgotten Bitcoin wallet from years ago can feel like finding a map to a hidden treasure. However, the excitement often turns to frustration when you realize you can’t access it. The promise of “free” recovery is appealing, but it’s essential to understand what it truly entails. This guide provides a realistic and professional overview of the methods available to recover funds from old wallet sites at little to no direct cost.

Understanding the Types of “Old Wallet Sites”

Your approach to recovery depends entirely on what type of wallet you used:

Custodial Web Wallets (Defunct): Services like Inputs.io or early web platforms that have shut down. If the company is bankrupt and gone, your funds are likely irretrievable unless a claims process was established.

Custodial Web Wallets (Active): Services like Blockchain.com or Coinbase where you hold an account. Your funds are still there, but you’ve lost login credentials.

Non-Custodial Web Wallets: Services where you were responsible for your private keys or seed phrase. Even if the website is gone, your funds are on the blockchain, not with the service. Recovery depends on finding your keys.

Browser-Based Wallets: Old extensions like early MetaMask versions or downloaded web wallets. Access requires the specific file or seed phrase.

Genuinely Free Recovery Methods

True free recovery is a process of self-help and digital archaeology. It requires time, patience, and effort, not money.

1. The Password Reset (For Active Custodial Services)

This is the most straightforward and truly free method. If the wallet service still exists, use their “Forgot Password” feature. This requires access to the original email account associated with the wallet. Check your email archives for any correspondence from the wallet service, as it may contain your username or wallet ID.

2. The Digital Archaeology Dig

Your most powerful free tool is a thorough search of your own digital history.

Search Old Devices: Scour hard drives, USBs, and old computers for any file named

wallet.dat,seed.txt, or anything similar.Search Email Archives: Meticulously search your email for the wallet service’s name. Look for welcome emails, transaction confirmations, or password reminders that might contain a hint or your username.

Check Physical Records: Many early users wisely printed their private keys or seed phrases. Check old safes, filing cabinets, and books for any slips of paper with a string of random words or characters.

3. Community Knowledge and Research

If the wallet site is defunct, your free option is research.

Bitcointalk.org: This is the historical record of Bitcoin. Search for the wallet’s name. There may be threads detailing shutdown procedures, community recovery efforts, or information on whether the company provided a way to export keys before closing.

Check for a Claims Process: Some bankrupt exchanges, like Mt. Gox, entered legal proceedings that created a process for users to file claims. Determine if your defunct service had a similar legal outcome.

The Reality of “Free” Technical Tools

You may find open-source software like BTCRecover designed to help brute-force wallet passwords. While the software itself is free, using it effectively is not.

Technical Expertise Required: Setting up and configuring these tools requires command-line knowledge.

Hardware Cost: Effective brute-forcing requires powerful GPUs, which consume significant electricity. The “free” software has a very real cost in hardware wear-and-tear and power consumption.

Time Investment: The process can take days, weeks, or even years for a complex password.

Therefore, while the tool is free, the process of using it has associated costs, making it “free” only if you already own the hardware and have the technical skills.

When “Free” Isn’t Enough: Recognizing the Need for Help

If you have a wallet file but a lost password, or a partial seed phrase, and the free methods have failed, your funds are not necessarily lost. However, recovering them will likely require professional help.

This is where “free” recovery ends and contingency-based services begin. Legitimate firms operate on a “No Recovery, No Fee” model. This means:

No Upfront Cost: You pay nothing if they are unsuccessful.

Success Fee: They take an agreed-upon percentage of the recovered funds.

This model is the safest and most ethical way to engage experts. It aligns their goals with yours and protects you from scams demanding advance payment.

Conclusion: Free Recovery is a DIY Process

Recovering funds from old Bitcoin wallet sites for free is possible, but it is primarily a task of investigation and data recovery on your part. The path is not paved with magic software but with diligent searching through your past digital footprints.

Exhaust all free options first: Password resets, searching old devices, and researching the defunct service.

Understand the costs: “Free” technical tools require expertise, hardware, and time.

Engage experts wisely: If you must seek help, only work with a service that uses a No Recovery, No Fee structure. Never pay upfront, and never share your private keys or seed phrase with anyone who contacts you first.

Recovering Funds from Old Bitcoin Wallet Sites: The key to unlocking your old wallet likely exists in your own records. A patient, thorough, and cautious approach is your greatest asset in reclaiming your digital treasure.

How to Recover Lost BTC

How to Recover Lost BTC

Recovering Funds from Old Bitcoin Wallet Sites: The immutable nature of the Bitcoin blockchain is its greatest strength and, for many, its most daunting feature. A single mistyped address, a forgotten password, or a successful phishing attack can seem like a digital death sentence for your coins. The panic that sets in is real, and the search for solutions often leads to a maze of misinformation and scams.

This guide establishes the first structured framework for understanding and addressing the loss of Bitcoin. We will move beyond generic advice to define the precise categories of loss and their corresponding, actionable recovery protocols.

The Foundation: Categorizing Your Loss

The single most important step is to correctly diagnose the type of loss. The recovery path for each is fundamentally different. There are three primary categories:

Technical Inaccessibility: The coins are in a wallet you own, but you cannot access it (e.g., lost password, corrupted drive, lost seed phrase).

Unintentional Transfer: The coins were sent to an incorrect or invalid Bitcoin address by mistake.

Theft & Fraud: The coins were taken from you through malicious means (e.g., hacking, scam websites, phishing).

Protocol 1: Recovery from Technical Inaccessibility

This is the most common scenario and often the most recoverable.

Step 1: Seed Phrase Restoration

Your 12 or 24-word mnemonic seed phrase is the master key. If you have it, even partially, recovery is possible.

Full Phrase Available: Simply import the phrase into a new, reputable software or hardware wallet. Your Bitcoin and entire transaction history will be restored.

Partial Phrase Available: If words are missing or the order is wrong, specialized software exists that can use the cryptographic checksum (the last word) to mathematically deduce the correct sequence. This process can be technically complex but is often successful for wallets with high value.

Step 2: File & Password Recovery

If your wallet is encrypted and you’ve forgotten the password, all is not lost.

Brute-Force Attacking: Software can be used to attempt billions of password combinations per second. Success depends entirely on the complexity of your original password. Simple passwords may be recovered in minutes; complex ones could take centuries.

Data Salvage: For a corrupted wallet file (e.g., wallet.dat) on a damaged hard drive, cease using the drive immediately and consult a professional data recovery service. They can often repair hardware and extract raw data for analysis.

Protocol 2: Addressing an Unintentional Transfer

Sending BTC to the wrong address is every user’s nightmare. Recovery is exceptionally difficult but not always impossible.

Typo in Address: Bitcoin addresses include a built-in checksum. If you make a typo, the wallet software will almost certainly reject it as invalid before you can even press “send.” Always check the first and last four characters of the address.

Valid but Wrong Address: If you sent to a valid address that you do not control, your only recourse is to:

Investigate the Address: Use a blockchain explorer to see if the address has any history or is associated with an exchange or custodian.

Contact the Owner: If the address is linked to a known service (like an exchange deposit address), contact their support immediately with the transaction ID. They may be able to credit your account.

Appeal to the Recipient: If it belongs to an individual, you may attempt to contact them. They have no obligation to return the funds, but it is your only hope.

Protocol 3: Responding to Theft and Fraud

This requires a shift from technical solution to investigative and legal strategy.

Step 1: Immediate Incident Response

Secure Remaining Assets: Immediately move any remaining funds to a new, secure wallet with a new seed phrase.

Document Everything: Compile a complete dossier: transaction IDs (TXID), the scammer’s wallet addresses, URLs of fraudulent sites, and screenshots of all communications.

Report to Authorities: File a formal report with your national cybercrime unit (e.g., FBI’s IC3 in the United States). This creates an official record, which is crucial for any future investigation.

Step 2: Engage in Strategic Tracing

Blockchain Analysis: While transactions are pseudonymous, they are public and permanent. Tools exist to trace the flow of your stolen funds. This is often where professional firms add value.

Exchange Notification: If your traced funds land in an account at a regulated exchange, that exchange can, under court order or their own terms of service, freeze the assets. Your official police report is key to initiating this process.

Crucial Advisory on “Recovery Services”:

As this is a new field, extreme caution is required. Legitimate actors will:

Never guarantee success.

Never ask for your private keys or seed phrases.

Operate on a “No Recovery, No Fee” model. You should not pay large upfront retainers.

The Prime Directive: Prevention

Recovery is a fraught process. The optimal strategy is a proactive defense:

Use a Hardware Wallet: Isolate your private keys from internet-connected devices.

The Metal Backup: Etch your seed phrase onto a fire- and water-resistant metal plate. Paper burns; ink fades.

The Triple-Verify Rule: Before any transaction, verify the wallet address three times: once when copying, once before pasting, and a final time before confirming.

Skepticism as a Default: Understand that offers of guaranteed returns or urgent requests for funds are hallmarks of fraud.

Recovering Funds from Old Bitcoin Wallet Sites

Losing Bitcoin is a severe event, but it is not necessarily final. By correctly categorizing your loss and methodically following the appropriate protocol, you maximize your chances of reclaiming your digital property. This structured approach provides the foundational knowledge every Bitcoin holder needs to navigate this challenging situation with clarity and purpose.

How to Find Lost or Stolen Bitcoin

How to Find Lost or Stolen Bitcoin: A Professional Guide to Recovery Strategies

Recovering Funds from Old Bitcoin Wallet Sites: The loss or theft of Bitcoin is a distressing event that highlights the critical responsibility that comes with self-custody. Unlike traditional finance, there is no central authority to call for a chargeback. The immutable nature of the blockchain means that while all transactions are transparent and traceable, they are also irreversible.

This guide provides a structured, professional approach to navigating the aftermath of lost or stolen BTC, outlining the steps to take, the tools available, and when to engage expert help.

First Step: Diagnose the Problem

Your course of action depends entirely on the nature of the incident. The strategies for finding stolen BTC are fundamentally different from those for recovering lost BTC.

Stolen Bitcoin: Funds that were illegally transferred out of your control due to hacking, phishing, fraud, or theft.

Lost Bitcoin: Funds that are still in your wallet but are inaccessible due to a forgotten password, lost private key, corrupted hardware, or incorrect transaction details.

Section 1: How to Investigate Stolen Bitcoin

If your Bitcoin was stolen, time is of the essence. The goal is to trace the funds and act quickly to have them frozen on centralized services.

1. Immediate Action: Gather Evidence

Transaction ID (TXID): Locate the TXID of the fraudulent transaction from your wallet or blockchain explorer. This is your primary piece of evidence.

Source Address: The wallet address the funds were sent from.

Destination Address: The wallet address the funds were sent to.

Document Everything: Take screenshots of everything, including wallet histories, phishing emails, fake website URLs, and any communication with the scammer.

2. Trace the Funds Using a Blockchain Explorer

Tools: Use explorers like Blockchain.com, Blockstream.info, or BTC.com to investigate the destination address.

Process: Follow the “flow” of the stolen funds. Sophisticated thieves will use “mixers” or break the funds into smaller amounts and send them through multiple addresses (a process known as “peeling”) to obfuscate their trail. Your goal is not to identify the thief but to see if the funds eventually land at a regulated cryptocurrency exchange (e.g., Coinbase, Binance, Kraken).

3. Report to Authorities and Exchanges

Law Enforcement: File a detailed report with your local police and relevant national cybercrime units (e.g., the FBI’s IC3 in the U.S., Action Fraud in the UK). Provide them with the TXID and all gathered evidence.

Exchange Reporting: If your tracing shows the funds were sent to an exchange, immediately contact that exchange’s fraud or support department. Exchanges can often freeze assets if provided with a valid law enforcement report. This is the most realistic chance of recovering stolen funds.

Section 2: How to Attempt Recovery of Lost Bitcoin

If your Bitcoin is lost due to an accessibility issue, the recovery process involves data reconstruction and cryptographic techniques.

1. For Lost Passwords or PINs (Encrypted Wallets):

Password Recovery Tools: Software like Hashcat or John the Ripper can be used to attempt to brute-force the password. This requires technical knowledge and powerful computing resources (high-end GPUs).

Professional Services: Specialized firms use optimized algorithms and dictionary attacks based on clues you provide (e.g., “I know it contained a name and a year”) to crack wallet passwords. They typically operate on a “No Recovery, No Fee” model.

2. For Lost or Corrupted Private Keys/Seed Phrases:

Data Recovery: If your key was stored on a corrupted hard drive or USB device, professional data recovery services can attempt to salvage the raw data and reconstruct the file containing the key.

Seed Phrase Reconstruction: If you have a partial seed phrase (e.g., 20 out of 24 words), the checksum embedded in the phrase can be used to mathematically deduce the missing words. Specialized software and services exist for this exact purpose.

3. For Incorrectly Sent Transactions:

This is extremely difficult. If you sent BTC to the wrong address (a mistyped address or one from a different cryptocurrency), recovery is nearly impossible due to cryptography. Some hope exists only if the address is owned by a known entity (like an exchange), and you can prove the error. Contact their support immediately.

Section 3: When to Engage a Professional Crypto Recovery Service

For most individuals, the technical and investigative hurdles are too high to manage alone. This is where professional recovery firms add value.

What They Do:

Advanced Blockchain Forensics: They use proprietary software and expertise to trace stolen funds far more effectively than an individual can.

Legal Liaison: They have established relationships with law enforcement agencies and exchanges, streamlining the process of freezing and seizing assets.

Cryptographic Recovery: They possess the advanced hardware and software needed to attempt password cracking and seed phrase recovery.

How to Choose a Legitimate Service:

No Upfront Fees: The industry standard for reputable firms is a contingency fee—they only get paid a percentage if they are successful.

Transparency: They should clearly explain their process and set realistic expectations, making no guarantees.

Verifiable Reputation: Look for independent reviews, case studies, and a public-facing team. Avoid any service that contacts you first.

Security: A legitimate firm will NEVER ask for your private keys or seed phrase.

Conclusion: Prevention is the Best Form of Recovery

While the prospect of finding lost or stolen Bitcoin exists, the process is arduous, expensive, and never guaranteed. The most effective strategy is proactive security:

Use a Hardware Wallet: Store the majority of your funds on a cold wallet disconnected from the internet.

Back Up Your Seed Phrase: Write it down on durable material (e.g., steel plates) and store multiple copies in secure, separate locations.

Verify Everything: Double-check addresses before sending transactions, be wary of unsolicited offers, and use bookmarks for exchange and DeFi sites to avoid phishing.

Educate Yourself: Understanding basic security practices is your strongest defense against both loss and theft.

Recovering Funds from Old Bitcoin Wallet Sites

Losing access to Bitcoin is a severe event, but it is not always final. By acting swiftly, methodically gathering evidence, and engaging the right professionals, you can maximize your chances of a successful recovery.

How to Claim Unclaimed Bitcoin

How to Claim Unclaimed Bitcoin: A Professional Guide to Recovering Lost Digital Assets

Recovering Funds from Old Bitcoin Wallet Sites: The decentralized and immutable nature of Bitcoin means that ownership is absolute—but only if you can prove it. Unlike a traditional bank, there is no central authority to call if you lose access to your funds. Billions of dollars worth of Bitcoin are estimated to be permanently lost or sitting unclaimed in wallets, often due to simple oversights, forgotten passwords, or incomplete estate planning. The process of claiming this unclaimed Bitcoin is not about filing a form with a central agency; it is a technical process of regaining access. This guide outlines the professional steps to identify and claim what is rightfully yours.

Understanding “Unclaimed” Bitcoin

In the context of cryptocurrency, “unclaimed Bitcoin” generally falls into one of three categories:

Lost Access: Bitcoin in a wallet to which the owner has lost the private keys, seed phrase, or password. This is the most common scenario.

Inheritance: Bitcoin held by a deceased family member whose heirs are unaware of the assets or lack the credentials to access them.

Abandoned on Exchanges or Platforms: Small balances left on trading platforms, in forgotten merchant accounts, or from defunct services like early Bitcoin faucets.

A Step-by-Step Guide to Claiming Unclaimed Bitcoin

The recovery method depends entirely on the specific situation. Follow this structured approach.

Step 1: Conduct a Thorough Investigation and Inventory

Before any technical recovery can begin, you must identify what exists and where it might be.

For Your Own Assets: Search your records for old hardware wallets, USB drives, and paper files. Look for any mention of:

Seed Phrases: 12, 18, or 24-word recovery phrases.

Private Keys: Long strings of letters and numbers, often starting with a ‘5’, ‘K’, or ‘L’.

Wallet Files: Files with extensions like

.dat(Bitcoin Core) or from other software wallets.Old Receipts/Notes: Any documentation that might hint at a password or a wallet address.

For Inheritance: Systematically search the deceased’s physical and digital belongings. Check secure storage devices, password managers, and financial documents for any clues. Look for transaction histories on known exchange accounts or bank statements showing purchases of cryptocurrency.

Step 2: Locate the Public Address

Knowing the public Bitcoin address is crucial. It allows you to verify the funds are still there on a blockchain explorer (e.g., blockchair.com, mempool.space) without needing the private key. You might find this address in:

Old transaction emails from exchanges.

Invoices or payment requests.

A previously used software wallet that shows the address but requires a password to spend.

Step 3: Choose the Appropriate Recovery Method

| Scenario | Primary Recovery Method | Process & Considerations |

|---|---|---|

| Forgotten Password (Encrypted Wallet File) | Brute-Force Recovery | Use specialized software (e.g., Hashcat, BTCRecover) to guess the password. Success depends on password strength and hints you can provide. Often requires technical expertise or hiring a professional service. |

| Lost Seed Phrase (Missing Words) | Seed Phrase Reconstruction | If you have a partial seed phrase, software can use the built-in checksum to mathematically deduce the missing words. The more words you have, the higher the chance of success. |

| Corrupted/Damaged Storage Device | Data Forensic Recovery | Engage a professional data recovery service to repair a damaged hard drive or SSD and extract the wallet file or key fragments. This often requires a clean-room environment for physical repairs. |

| Funds on a Known Exchange | Account Recovery Process | Use the exchange’s standard account recovery process. This typically involves verifying your identity with government-issued ID, proof of address, and answering security questions. This can be a lengthy process but is often successful. |

| Inheritance without Credentials | Legal Grant of Representation | You will likely need to work with a probate lawyer to obtain a grant of representation (e.g., Letters of Testamentary). This legal document, which proves your right to access the estate, can then be presented to exchanges or to a technical recovery firm to gain access to the assets. |

Step 4: Engage Professional Services When Necessary

For technically complex cases (e.g., valuable wallet with a lost password), engaging a professional crypto recovery firm is often the most practical solution.

What They Do: These firms use advanced techniques—optimized brute-force attacks, sophisticated data carving, and cryptanalysis—to attempt recovery.

How to Choose:

“No Recovery, No Fee” Model: Only work with firms that operate on a contingency basis, taking a percentage of the recovered funds. Never pay large upfront fees.

Reputation and Transparency: Research their track record, read independent reviews, and ensure they communicate their process clearly without making unrealistic guarantees.

Security: They should never ask for your sole copy of a seed phrase or private key. A legitimate firm will use secure methods that do not require you to relinquish control of your sensitive information.

Prevention: The Best Strategy for the Future

The difficulty of reclaiming unclaimed Bitcoin highlights the critical importance of proactive security and planning.

Secure Backup: Store your seed phrase on durable media (e.g., cryptosteel) in multiple secure physical locations.

Use a Hardware Wallet: Keep the majority of your assets in cold storage, disconnected from the internet.

Estate Planning: Explicitly include your digital assets in your will. Use a secure method to provide instructions for access to a trusted beneficiary without compromising your keys while you are alive (e.g., using a multi-signature wallet or a lawyer-led secret sharing process).

Conclusion

Recovering Funds from Old Bitcoin Wallet Sites

Claiming unclaimed Bitcoin is a challenging but often possible endeavor. It requires meticulous investigation, a clear understanding of the specific access problem, and the judicious use of technical tools or professional services. By approaching the process methodically and with realistic expectations, individuals and heirs can successfully recover significant digital wealth that was once thought to be lost forever. The journey to reclaim lost Bitcoin is a powerful reminder that in a decentralized system, the responsibility for securing and bequeathing assets rests solely with the owner.

How to Restore Your Wallet Using a Cloud Backup

How to Restore Your Wallet Using a Cloud Backup: A Secure and Efficient Recovery Guide

Recovering Funds from Old Bitcoin Wallet Sites: In the dynamic world of cryptocurrency, the ability to recover your digital assets is as crucial as securing them. While hardware wallets and paper backups are gold standards for cold storage, they can be vulnerable to physical damage, loss, or misplacement. For users seeking a more integrated and accessible solution, restoring a wallet using a cloud backup offers a powerful alternative. This guide outlines the professional best practices for leveraging cloud backups to seamlessly and securely regain access to your funds.

Understanding Cloud Backup for Crypto Wallet

It is vital to clarify what a “cloud backup” entails in this context. We are not referring to storing a raw private key or seed phrase in a plaintext file on Google Drive or iCloud—a highly insecure practice.

Instead, modern, reputable wallet applications often incorporate encrypted, user-controlled cloud backup as a core feature. This process typically involves:

The wallet software encrypting your recovery seed phrase on your device before it ever leaves your possession.

Using a strong, user-created password to encrypt this data. This password is never sent to the cloud provider or the wallet company.

The encrypted file is then securely synced to your private account on a cloud service like iCloud or Google Drive.

This method combines the convenience of cloud accessibility with the security of client-side encryption. You are using the cloud as a secure transport and storage mechanism for an encrypted blob of data, not for your sensitive secrets themselves.

A Step-by-Step Guide to Restoring Your Wallet

The exact steps may vary slightly between wallet providers (e.g., Trust Wallet, Exodus, Atomic Wallet), but the general principle remains consistent.

Prerequisites for Restoration:

The Original Wallet App: Install the same wallet application you used to create the backup on a new or reset device.

Cloud Account Credentials: Access to the same iCloud or Google account used for the original backup.

Your Encryption Password: The strong, unique password you created to encrypt the backup. Without this password, the encrypted cloud file is useless.

The Restoration Process:

Initiate Wallet Recovery: Open the wallet application on your new device. Instead of selecting “Create a New Wallet,” look for an option labeled “Import Wallet,” “Restore Wallet,” or “Recover from Cloud Backup.”

Authenticate with Your Cloud Provider: The wallet app will prompt you to sign in to your iCloud or Google account. This authentication is handled through secure, standard APIs provided by Apple and Google.

Locate the Encrypted Backup: Once authenticated, the wallet app will scan your cloud storage for a valid, recognized backup file. It will typically present you with a list of available backups if you have more than one.

Decrypt with Your Password: After selecting the correct backup, the application will prompt you to enter the encryption password you created initially. This password is used to decrypt the file locally on your device. The password is not transmitted over the internet.

Wallet Restoration Complete: If the correct password is entered, the app will decrypt the seed phrase, rebuild your wallet, and resynchronize with the blockchain. Your complete transaction history and balance will reappear, as this information is stored on the public ledger, not within the backup itself.

Critical Security Considerations and Best Practices

The security of this method hinges entirely on two factors: the strength of your encryption password and the security of your cloud account.

1. The Encryption Password is Paramount:

This password is the sole key to your encrypted backup. If it is weak, forgotten, or lost, the backup is irrecoverable.

Treat this password with the same severity as your seed phrase itself. It is recommended to store it separately in a secure password manager or another safe location.

The wallet company cannot recover or reset this password. This is a deliberate security feature known as “zero-knowledge” architecture.

2. Fortify Your Cloud Account:

Enable Two-Factor Authentication (2FA): Your cloud account (Google, Apple, etc.) must be protected with strong, unique credentials and robust 2FA. A compromised cloud account could allow an attacker to delete your backup or attempt brute-force attacks on the encrypted file.

Use a Primary Email: Ensure the email associated with your cloud account is secure and not used on other unreliable websites to prevent phishing attempts.

3. Understand the Trust Model:

You are placing trust in the wallet developer to have implemented the encryption and backup process correctly.

You are also trusting the security infrastructure of your cloud provider (Apple/Google). While generally very secure, these accounts can be targeted by sophisticated attackers.

Advantages and Disadvantages of Cloud Backups

Advantages:

Convenience: The restoration process is streamlined and user-friendly, ideal for less technically inclined users.

Accessibility: Allows for easy wallet recovery across multiple devices (e.g., phone, tablet) without manually entering a long seed phrase.

Protection Against Physical Loss: Safeguards your recovery phrase from physical disasters like fire or flood that could destroy a paper backup.

Disadvantages:

Online Attack Vector: The encrypted file is stored online, making it a potential target for attackers, though it is useless without the password.

Dependency on Third Parties: Relies on the wallet app’s functionality and the cloud provider’s availability.

Password Dependency: Adds another critical piece of information (the encryption password) that must be remembered and secured.

Conclusion: A Balanced Approach to Security

Restoring a wallet from an encrypted cloud backup is a professionally recognized method that brilliantly balances security with convenience. It significantly reduces the risk of losing access to your funds due to a lost or damaged physical backup.

However, it should not be your only backup. For maximum security, a multi-strategy approach is recommended:

Use the encrypted cloud backup for convenience and accessibility.

Maintain a physical, offline record of your seed phrase stored in a secure location like a safe or safety deposit box. This remains your ultimate failsafe.

By understanding the process and adhering to strict security practices—namely, using a strong, unique encryption password and enabling 2FA on your cloud account—you can confidently use cloud backups as a reliable and efficient tool in your cryptocurrency security toolkit.

Recovering Funds from Old Bitcoin Wallet Sites

Disclaimer: The security of your assets is your responsibility. Always ensure you understand the backup and restore features of your chosen wallet software. This article is for informational purposes only and does not constitute security advice.

How to Find Inactive Bitcoin Wallets

How to Find Inactive Bitcoin Wallets: A Professional Guide to Dormant Digital Assets

The Bitcoin blockchain is a vast, immutable public ledger containing over 900,000 blocks and hundreds of millions of transactions. Within this digital expanse lies a fascinating phenomenon: inactive or “dormant” wallets. These are addresses that received a Bitcoin balance at some point but have seen no outbound transactions for a very long period—often years or even since the early days of the network.

The concept of finding these wallets is of significant interest to various parties, from blockchain analysts and researchers to investors and estate planners. This article provides a professional overview of the methods, tools, and important ethical and legal considerations involved in identifying inactive Bitcoin wallets.

Understanding “Inactive” or “Dormant” Wallets

An inactive Bitcoin wallet is not a special type of wallet; it is simply an address whose private keys have not been used to sign a spending transaction for an extended time. Common reasons for dormancy include:

Lost Keys: The owner has lost the private keys or seed phrase, rendering the funds permanently inaccessible.

HODLing: A long-term investor is intentionally holding (“HODLing”) their assets and has not moved them.

Forgotten Assets: The owner may have forgotten about a small wallet used for testing or a minor transaction.

Deceased Owner: The keys may be part of an unmanaged or unknown digital estate.

It is crucial to understand that finding an inactive wallet does not grant ownership. Ownership is proven exclusively by control of the private keys. The process of finding is one of analysis, not acquisition.

Professional Methods for Identifying Inactive Wallets

Identifying dormancy involves scanning the public blockchain for specific patterns and using specialized tools. Here are the primary methods:

1. Blockchain Explorers and Analysis Platforms:

This is the most accessible starting point. Powerful blockchain explorers like Blockchair, BTC.com, and Blockstream.info allow you to inspect any address. You can see its transaction history, total received, final balance, and the date of its last activity.

To manually find inactive addresses, you would typically:

Look up a known early adopter’s address or a address from a famous transaction.

Follow the trail of transactions from that point, checking the activity date of subsequent addresses.

This method is slow and inefficient for large-scale analysis.

2. Analyzing the “UTXO Set”:

Bitcoin uses a model called Unspent Transaction Outputs (UTXOs). A UTXO is essentially a discrete chunk of bitcoin that is available to be spent. The entire network’s spendable bitcoin is contained within the UTXO set.

By analyzing the UTXO set, researchers can filter for outputs that were created a long time ago but have never been spent.

A UTXO created in 2012 that remains unspent is a strong indicator of a dormant wallet.

3. Utilizing On-Chain Analytics Software and APIs:

For professional and large-scale analysis, firms use advanced software and data providers like Chainalysis, Glassnode, or Coin Metrics. These platforms offer:

Custom Scripts: Programmatically scanning the blockchain for addresses with no outgoing transactions since a specific block height or timestamp.

Cluster Analysis: Grouping addresses believed to be owned by the same entity (a “wallet cluster”) to analyze the behavior of a whole wallet, not just a single address.

Rich Lists: Tracking the distribution of wealth among addresses, often highlighting large, old holdings that have not moved.

4. Investigating Early Blocks and Coinbase Transactions:

A specific area of interest is the wallets that received mining rewards (coinbase transactions) from the earliest blocks. Many of these wallets have never spent their rewards, and their contents are now worth fortunes. Their addresses are a matter of public record (e.g., the Genesis Block reward address), and their inactivity is easily verifiable.

Key Metrics and Patterns to Identify

When searching for dormancy, analysts look for these specific signals:

Last Activity Date: The most straightforward metric. The date of the last incoming or outgoing transaction.

Age of the Oldest UTXO: How long ago the oldest unspent chunk of bitcoin in the address was received.

Value: The current balance of the address. High-value dormant wallets are naturally of greater interest.

Origin of Funds: Whether the funds came from mining rewards, an exchange, or another known entity.

Important Legal and Ethical Considerations

The search for dormant wallets is fraught with potential pitfalls. It is imperative to operate within legal and ethical boundaries.

No Implied Ownership: Identifying an address does not give you any claim to its contents. The funds belong solely to the holder of the private keys.

Privacy: While the blockchain is public, aggregating data to de-anonymize an individual without consent raises significant privacy concerns. Ethical analysts focus on the data, not the person.

Abandonment Laws: Laws regarding abandoned property (escheatment) are complex and vary drastically by jurisdiction. They are also poorly defined for cryptocurrency. Assuming a wallet is “abandoned” after a certain period is a legal determination, not an analytical one.

Scam Avoidance: Be wary of any service that claims it can “reactivate” or “recover” dormant wallets for you, especially if they demand an upfront fee. This is a common scam targeting those who misunderstand blockchain technology.

Potential Use Cases for This Analysis

Despite the challenges, this analysis has legitimate professional applications:

Market Analysis: Economists and investors study dormancy to understand investor sentiment (e.g., are long-term holders selling?).

Estate Planning and Recovery: Heirs or executors of an estate might work with a specialized crypto recovery company to analytically prove the existence of digital assets within an estate, which is the first step before any potential recovery efforts can begin.

Chainalysis and Compliance: Tracking the movement of dormant coins (e.g., from a 2013 hack) is critical for exchanges and compliance officers to prevent the laundering of stolen funds.

Academic Research: Researchers study the distribution and movement of bitcoin to understand economic behaviors and the health of the network.

Conclusion

Finding inactive Bitcoin wallets is a technically complex endeavor that leverages the transparent nature of the blockchain. While advanced tools and analytical techniques make it possible to identify these dormant assets with high precision, it is an activity that must be approached with a clear understanding of its limitations.

The true challenge lies not in finding the wallets, but in legally and ethically navigating what their dormancy represents. For those who believe they may have lost access to a wallet, the first step is a professional self-audit of old devices and records. For everyone else, the dormant wallets of the blockchain serve as a permanent, public museum of Bitcoin’s history, a testament to its resilience, and a reminder of the absolute responsibility that comes with self-custody.

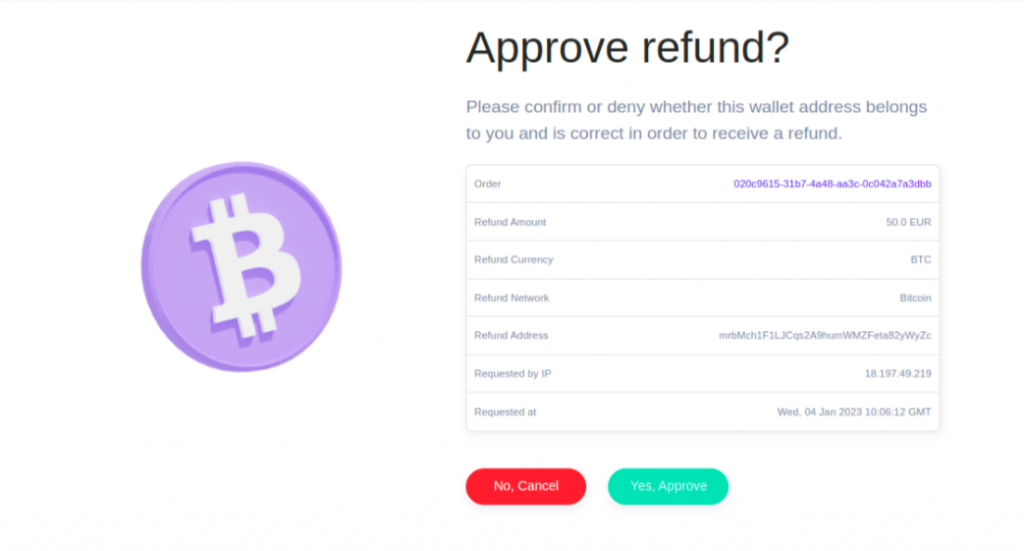

BTC Refund

BTC Refund: Understanding the Possibility of Recovering Lost Bitcoin

The irreversible nature of Bitcoin transactions is a foundational feature of its design. Unlike credit card payments or traditional bank transfers, a BTC transaction, once confirmed on the blockchain, is permanent and cannot be unilaterally reversed. This immutability is a strength for security and trust in the protocol but becomes a significant vulnerability when users fall victim to fraud, error, or theft.

The concept of a “BTC refund” is therefore often misunderstood. This article provides a professional overview of what a BTC refund truly entails, the realistic scenarios for recovery, and the mechanisms—both technical and legal—that can potentially lead to the return of lost funds.

The Myth of the Simple Refund

It is critical to begin with a clear statement: There is no “refund button” on the Bitcoin network. The protocol itself has no built-in mechanism to cancel a transaction or force a return of funds from a recipient. Any promise of a simple, automated refund is likely a scam targeting desperate victims.

A “BTC refund” is not a technical reversal but the result of a successful recovery process. This process is complex, time-consuming, and requires specialized expertise. It is not guaranteed and depends entirely on the specific circumstances of the loss.

Realistic Scenarios for Bitcoin Recovery (“Refunds”)

Recovery is possible in situations where an external party can be persuaded or compelled to return the assets. The feasibility depends on the nature of the transaction.

1. Human Error and Self-Initiative

Scenario: You send BTC to the wrong cryptocurrency wallet address (e.g., a Bitcoin Cash address) or to a colleague who was expecting payment.

Recovery Path: This is the simplest scenario. If the address belongs to a known entity (like an exchange or an individual), you can contact their support or the recipient directly, provide proof of the transaction, and request a voluntary return. Many reputable services have processes for handling these erroneous deposits.

2. Fraudulent Merchants and Failed Services (Chargeback via Legal Means)

Scenario: You pay a merchant or service provider in BTC, but they fail to deliver the product or service as promised.

Recovery Path: While the transaction is immutable, the legal agreement behind it is not. You may pursue a civil claim for breach of contract or fraud. If the merchant is a registered, identifiable business, a court order can compel them to refund the fiat equivalent of the BTC. This path relies on the merchant’s willingness to comply or the ability of law enforcement to enforce the judgment.

3. Theft, Hacks, and Sophisticated Scams (The Role of Recovery Services)

Scenario: Your funds are stolen through a phishing attack, a fake investment (rug pull), or a hack of your wallet or exchange.

Recovery Path: This is the most complex scenario and often requires professional intervention. Specialized crypto recovery firms employ:

Blockchain Forensics: Experts trace the flow of stolen funds across the blockchain to identify the destination wallets.

Exchange Collaboration: If the stolen funds are sent to a centralized exchange (e.g., Coinbase, Binance), the recovery firm can work with that exchange’s compliance team to freeze the assets and, if presented with a valid court order, have them seized and returned.

Legal Action: Recovery services often work with law enforcement agencies to build a case against the identified perpetrators, leading to potential asset seizure and restitution.

It is vital to note that these firms typically operate on a “No Recovery, No Fee” basis. Any service demanding large upfront payments should be considered a potential scam.

The Critical Role of Centralized Exchanges

Centralized exchanges (CEXs) are the most common chokepoint for recovery. While Bitcoin itself is decentralized, the off-ramps where criminals try to cash out are not. Exchanges are required to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. This means they can identify their users and, under a legal order, freeze funds linked to illicit activity. Promptly reporting the theft to any exchange you believe received your funds is a crucial first step.

How to Protect Yourself: Prevention Over “Refund”

Given the extreme difficulty of obtaining a refund, the best strategy is proactive protection:

Triple-Check Addresses: Always verify a wallet address by checking the first and last four characters before sending a significant amount. Use copy-paste functions rather than manual entry.

Use a Test Transaction: For large transfers, first send a small, minimal-value test transaction to confirm the address is correct.

Verify Counterparties: Only transact with reputable merchants and services. Conduct due diligence before investing in any project.

Secure Your Storage: Use a hardware wallet for significant holdings and enable all available security features (multi-signature, passphrase) to prevent unauthorized access.

Conclusion

A “BTC refund” is a misnomer for a multifaceted recovery process that blends technical investigation, legal action, and cooperation with regulated intermediaries. It is not an automatic right but a potential outcome based on the specific circumstances of the loss.

While the decentralized protocol offers no undo function, the evolving ecosystem of blockchain intelligence firms, legal frameworks, and compliant exchanges provides a beacon of hope for victims of theft and fraud. If you suffer a loss, act quickly: gather all transaction details (TXID, addresses, timestamps), report the crime to law enforcement, and if pursuing professional help, only engage with transparent, reputable recovery services that operate on a success-fee model. In the world of Bitcoin, the ultimate responsibility for security—and the best chance of avoiding the need for a refund—lies with the user.